Novo Nordisk will spend billions of dollars to grow its foothold in treating a common liver condition, agreeing on Thursday to buy Akero Therapeutics for a drug that’s currently in late-stage testing.

Novo will pay $54 per share, or about $4.7 billion upfront, for California-based Akero and its lead drug, known as efruxifermin. Akero stockholders could see another $6 per share in payouts via a so-called contingent value right if efruxifermin is approved by U.S. regulators.

In buying Akero, Novo is adding to a recent upswing in dealmaking involving drugs for the liver disease known as metabolic dysfunction-associated steatohepatitis, or MASH. GSK bought one prospect from privately held Boston Pharmaceuticals in May, and Roche acquired another through a deal for 89bio last month. All three deals were centered around medicines that mimic the activity of a metabolism-balancing hormone called FGF21.

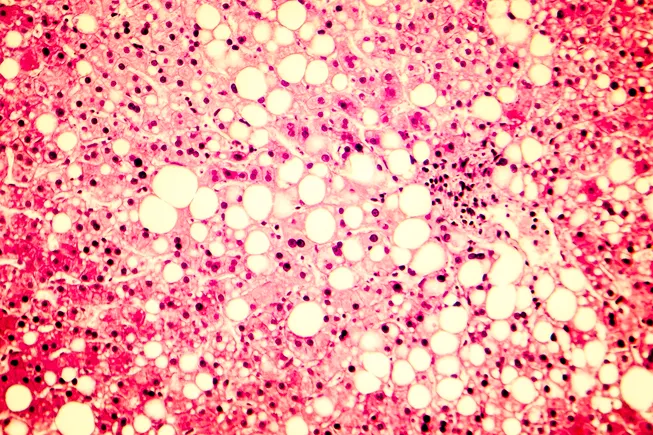

Should it succeed in Phase 3 testing and get to market, efruxifermin would add a new pharmaceutical option for MASH, a disease characterized by a buildup of fatty tissue in the liver. After years of research struggles, drugmakers have started to see some success in treating MASH, a largely silent disorder linked to other metabolic conditions like diabetes and obesity. Madrigal Pharmaceuticals last year gained approval for Rezdiffra, the first specific drug approved for the condition.

At the same time, FGF21 targeting agents like efruxifermin have been under development. Developers have been hoping that these drugs might not only cut liver fat and inflammation, but alleviate the dangerous buildup of scar tissue that accumulates in people with MASH.

Study data so far have been mixed, though. Novo stopped developing its own FGF21 candidate earlier this year, even as Akero and 89bio’s drugs had shown promise. In August, Leerink Partners analysts argued in a client note that Novo’s decision showed “not all FGF21 analogs are created equal” and was evidence of “positive differentiation” for drugs like Akero’s.

Novo, for its part, believes it’s acquired the best drug in the class. In Phase 2 testing, the highest dose of efruxifermin was associated with an improvement in liver scarring without worsening of the condition in almost a third of patients who received it for 96 weeks. A Phase 3 trial completed enrollment in January and should produce data next year.

Novo is well-known for its popular drugs for diabetes and obesity. Like those two conditions, MASH is expected to grow in prevalence in the years ahead, making it a top target for Novo. Earlier this year, its medication Wegovy became the first so-called incretin therapy to win an approval for MASH. The company sees Akero’s drug as a potential “cornerstone therapy” for MASH that could be used “alone or together with Wegovy,” CEO Mike Doustdar said in a statement.

The deal also may help reassure Novo investors who have seen the company’s once-dominant position in obesity eroded by competition from Eli Lilly’s Zepbound and sellers of copycat medicines. The company’s share price has lost nearly half of its value over the last year, and it recently restructured in the hopes of boosting future growth.

Novo said the deal won’t affect its projected 10% to 16% in operating profit growth this year, but it will lower its expected free cash flow outlook by about $4 billion. The acquisition will also increase research and development costs in 2026 and cut operating profit growth by 3 percentage points, the company said.