Merck & Co. is spending billions of dollars to gain rights to a new kind of preventive flu medicine, hoping that the treatment is poised to become a top seller in the years ahead.

The pharmaceutical giant on Friday agreed to acquire Cidara Therapeutics, the San Diego-based developer of that medicine, in a deal worth $9.2 billion. Merck is paying $221.50 per share for the company, a 109% premium to its closing price on Thursday.

News of the pending buyout was first reported by The Financial Times on Thursday.

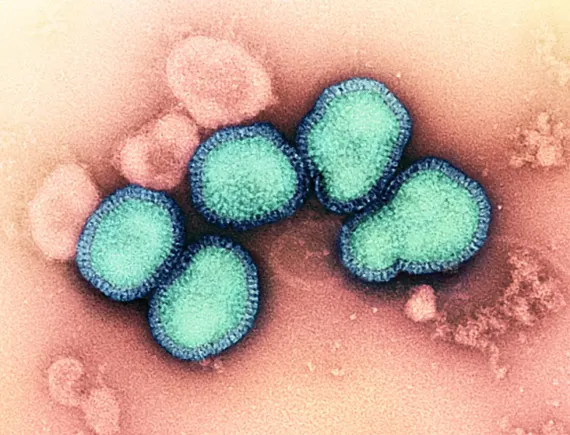

The deal revolves around a prospect currently known as CD388. It’s an antiviral that combines a small molecule with a protein fragment. Cidara has been evaluating it as a long-acting, preventive therapy for seasonal influenza, one of the world’s most common respiratory infections.

Flu shots are widely available, but their effectiveness can vary year to year and some people might not be eligible based on allergies to some vaccine components. Uptake has also been declining in recent years amid a surge in vaccine hesitancy and misinformation. Acute treatments, such as Tamiflu, are only somewhat beneficial too.

CD388 could emerge as an alternative. It’s designed to provide broad coverage against the A and B strains of influenza that lasts through a full flu season. In mid-stage testing earlier this year, CD388 showed the ability to prevent flu symptoms in roughly three-quarters of those who received it, compared to a placebo, over six months. Cidara, which once focused on an antifungal treatment before changing course, has seen its stock skyrocket on the program’s promise. Prior to the deal, Cidara shares had climbed 600%, to more than $105 apiece, over the last year.

CD388 is now in late-stage testing, with interim study results expected next year. It’s also been granted a type of Food and Drug Administration designation that should speed up a future review. In recent research notes, the team of analysts at RBC Capital Markets projected a $3.8 billion market opportunity for Cidara’s drug.

For Merck, that kind of upside will be critical in replacing the revenue it stands to lose when Keytruda, its top-selling cancer immunotherapy, loses patent protection later this decade. The company has already announced plans to redirect spending toward newly launched drugs and experimental treatments that might spur future growth. It’s turned to dealmaking to boost that effort too, having in July spent $10 billion on Verona Pharma for a lung disease drug.

“We continue to execute our science-led business development strategy, augmenting our pipeline with CD388, a potentially first-in-class, long-acting antiviral designed to prevent influenza in individuals at higher risk of complications,” said Merck CEO Rob Davis in a statement.

The Financial Times report on Thursday indicated multiple bidders were interested in Cidara. But RBC’s Brian Abrahams, in a note Friday, noted how Merck and Cidara’s boards have both agreed to the deal and it’s “unclear whether another player would be interested in coming in with a higher bid at this level.”

The acquisition is the latest in a recent upturn in biotech dealmaking that’s fueled a larger sector rally. October was the most active month for company acquisitions in years, according to BioPharma Dive data, and three more deals have been announced this month.